California Effective Tax Rate . california has nine state income tax rates, ranging from 1% to 12.3%. your average tax rate is 10.94% and your marginal tax rate is 22%. welcome to the 2021 income tax calculator for california which allows you to calculate income tax due, the effective tax rate. find prior year tax rate schedules using the forms and publications search. This marginal tax rate means that your immediate additional. Your tax rate and bracket depend on your income. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. Chris and pat smith are filing a joint tax return using. how to figure tax using the 2023 california tax rate schedules. you are able to use our california state tax calculator to calculate your total tax costs in the tax year 2024/25. california state tax quick facts. Calculate your tax using our calculator or look it up.

from soquelbythecreek.blogspot.com

california state tax quick facts. This marginal tax rate means that your immediate additional. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. Your tax rate and bracket depend on your income. you are able to use our california state tax calculator to calculate your total tax costs in the tax year 2024/25. how to figure tax using the 2023 california tax rate schedules. Chris and pat smith are filing a joint tax return using. california has nine state income tax rates, ranging from 1% to 12.3%. your average tax rate is 10.94% and your marginal tax rate is 22%. welcome to the 2021 income tax calculator for california which allows you to calculate income tax due, the effective tax rate.

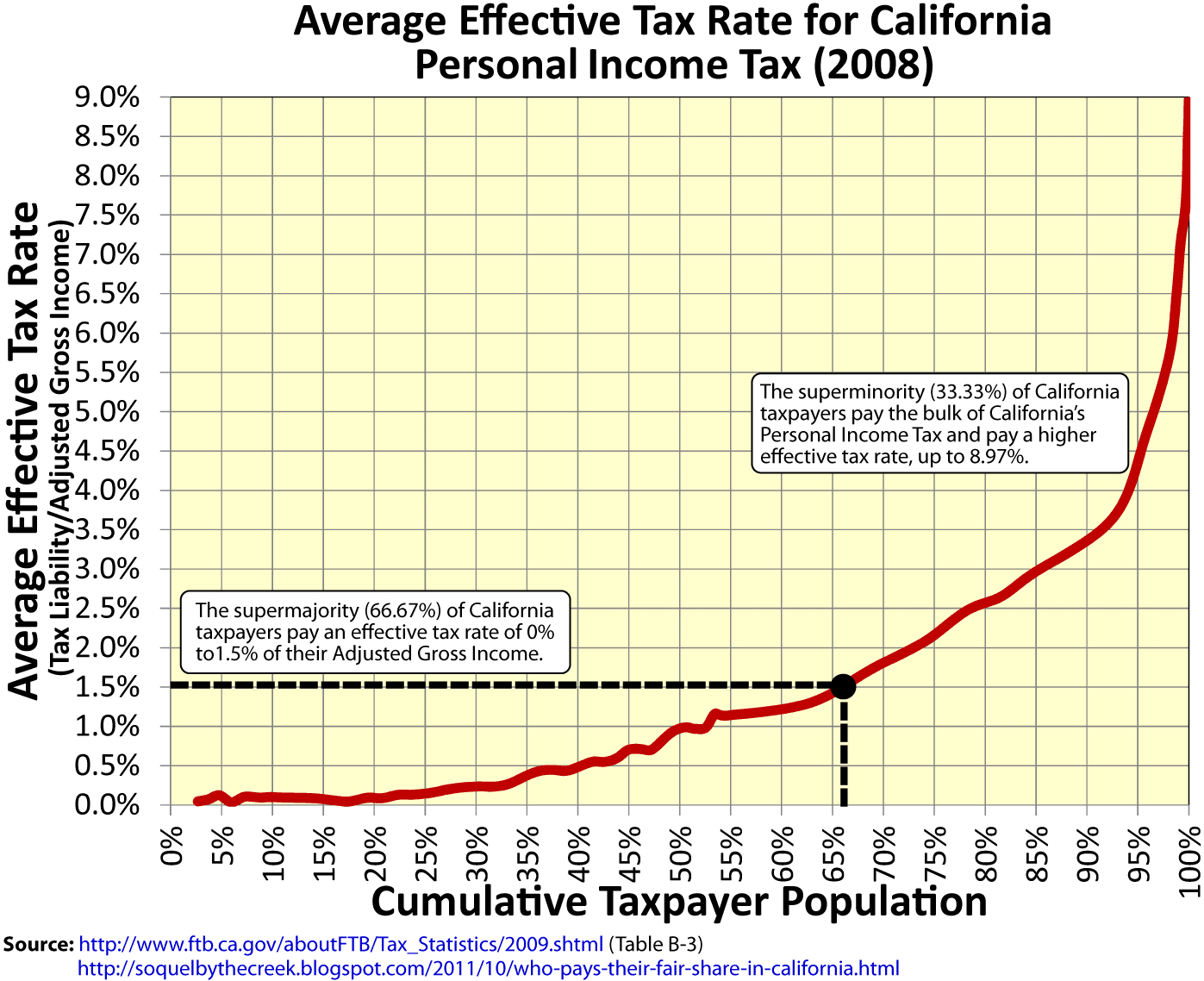

Creekside Chat Who Pays Their "Fair Share" in California?

California Effective Tax Rate Your tax rate and bracket depend on your income. welcome to the 2021 income tax calculator for california which allows you to calculate income tax due, the effective tax rate. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. california state tax quick facts. how to figure tax using the 2023 california tax rate schedules. Chris and pat smith are filing a joint tax return using. your average tax rate is 10.94% and your marginal tax rate is 22%. california has nine state income tax rates, ranging from 1% to 12.3%. This marginal tax rate means that your immediate additional. you are able to use our california state tax calculator to calculate your total tax costs in the tax year 2024/25. Your tax rate and bracket depend on your income. Calculate your tax using our calculator or look it up. find prior year tax rate schedules using the forms and publications search.

From dxootsfup.blob.core.windows.net

California Effective Tax Rate 2021 at Phillip Hill blog California Effective Tax Rate welcome to the 2021 income tax calculator for california which allows you to calculate income tax due, the effective tax rate. california has nine state income tax rates, ranging from 1% to 12.3%. Chris and pat smith are filing a joint tax return using. This marginal tax rate means that your immediate additional. your average tax rate. California Effective Tax Rate.

From www.richardcyoung.com

How High are Tax Rates in Your State? California Effective Tax Rate Chris and pat smith are filing a joint tax return using. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. california state tax quick facts. welcome to the 2021 income tax calculator for california which allows you to calculate income tax due,. California Effective Tax Rate.

From www.slideserve.com

PPT Analyzing the Tax Rate PowerPoint Presentation, free download California Effective Tax Rate california state tax quick facts. welcome to the 2021 income tax calculator for california which allows you to calculate income tax due, the effective tax rate. Calculate your tax using our calculator or look it up. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined. California Effective Tax Rate.

From www.taxpolicycenter.org

Effective tax rate by AGI Tax Policy Center California Effective Tax Rate Chris and pat smith are filing a joint tax return using. california state tax quick facts. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. welcome to the 2021 income tax calculator for california which allows you to calculate income tax due,. California Effective Tax Rate.

From www.thebalance.com

A List of Tax Rates for Each State California Effective Tax Rate how to figure tax using the 2023 california tax rate schedules. your average tax rate is 10.94% and your marginal tax rate is 22%. california has nine state income tax rates, ranging from 1% to 12.3%. Your tax rate and bracket depend on your income. This marginal tax rate means that your immediate additional. in california,. California Effective Tax Rate.

From www.investopedia.com

Effective Tax Rate How It's Calculated and How It Works California Effective Tax Rate This marginal tax rate means that your immediate additional. your average tax rate is 10.94% and your marginal tax rate is 22%. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. welcome to the 2021 income tax calculator for california which allows. California Effective Tax Rate.

From dxootsfup.blob.core.windows.net

California Effective Tax Rate 2021 at Phillip Hill blog California Effective Tax Rate Your tax rate and bracket depend on your income. how to figure tax using the 2023 california tax rate schedules. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. This marginal tax rate means that your immediate additional. you are able to. California Effective Tax Rate.

From www.epi.org

Effective tax rates, now in color! Economic Policy Institute California Effective Tax Rate california state tax quick facts. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. california has nine state income tax rates, ranging from 1% to 12.3%. welcome to the 2021 income tax calculator for california which allows you to calculate income. California Effective Tax Rate.

From www.taxpolicycenter.org

T220074 Average Effective Federal Tax Rates All Tax Units, By California Effective Tax Rate you are able to use our california state tax calculator to calculate your total tax costs in the tax year 2024/25. Calculate your tax using our calculator or look it up. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. welcome to. California Effective Tax Rate.

From www.blog.rapidtax.com

California Tax RapidTax California Effective Tax Rate Chris and pat smith are filing a joint tax return using. how to figure tax using the 2023 california tax rate schedules. This marginal tax rate means that your immediate additional. Calculate your tax using our calculator or look it up. welcome to the 2021 income tax calculator for california which allows you to calculate income tax due,. California Effective Tax Rate.

From www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know California Effective Tax Rate how to figure tax using the 2023 california tax rate schedules. your average tax rate is 10.94% and your marginal tax rate is 22%. welcome to the 2021 income tax calculator for california which allows you to calculate income tax due, the effective tax rate. This marginal tax rate means that your immediate additional. Calculate your tax. California Effective Tax Rate.

From www.irstaxapp.com

Fastest 2022 California Tax Calculator With Tax Rates Internal California Effective Tax Rate your average tax rate is 10.94% and your marginal tax rate is 22%. Your tax rate and bracket depend on your income. in california, the tax rate is defined by the county and is calculated on the property's market value, which is determined by county authorities. welcome to the 2021 income tax calculator for california which allows. California Effective Tax Rate.

From calbudgetcenter.org

California's Tax & Revenue System Isn't Fair for All California California Effective Tax Rate california has nine state income tax rates, ranging from 1% to 12.3%. california state tax quick facts. Chris and pat smith are filing a joint tax return using. your average tax rate is 10.94% and your marginal tax rate is 22%. Calculate your tax using our calculator or look it up. This marginal tax rate means that. California Effective Tax Rate.

From pgpf.org

Effective individual and payroll tax rates California Effective Tax Rate you are able to use our california state tax calculator to calculate your total tax costs in the tax year 2024/25. Calculate your tax using our calculator or look it up. This marginal tax rate means that your immediate additional. how to figure tax using the 2023 california tax rate schedules. welcome to the 2021 income tax. California Effective Tax Rate.

From taxfoundation.org

The Top 1 Percent’s Tax Rates Over Time Tax Foundation California Effective Tax Rate find prior year tax rate schedules using the forms and publications search. california state tax quick facts. you are able to use our california state tax calculator to calculate your total tax costs in the tax year 2024/25. how to figure tax using the 2023 california tax rate schedules. welcome to the 2021 income tax. California Effective Tax Rate.

From sadellawmeris.pages.dev

State Tax Comparison 2024 Meris Steffie California Effective Tax Rate you are able to use our california state tax calculator to calculate your total tax costs in the tax year 2024/25. This marginal tax rate means that your immediate additional. california has nine state income tax rates, ranging from 1% to 12.3%. how to figure tax using the 2023 california tax rate schedules. Chris and pat smith. California Effective Tax Rate.

From studylib.net

California Withholding Tax Rate Table 5 Effective January 1, 2012 California Effective Tax Rate how to figure tax using the 2023 california tax rate schedules. find prior year tax rate schedules using the forms and publications search. california has nine state income tax rates, ranging from 1% to 12.3%. Chris and pat smith are filing a joint tax return using. your average tax rate is 10.94% and your marginal tax. California Effective Tax Rate.

From www.slowboring.com

The case for a tax swap by Milan Singh Slow Boring California Effective Tax Rate how to figure tax using the 2023 california tax rate schedules. This marginal tax rate means that your immediate additional. welcome to the 2021 income tax calculator for california which allows you to calculate income tax due, the effective tax rate. find prior year tax rate schedules using the forms and publications search. Chris and pat smith. California Effective Tax Rate.